Ira Income Limits 2025 Married Filing Jointly. $146,000 for all other individuals. — start with your modified agi.

$7,000 per individual in 2025. Anyone with an earned income and their spouses, if married and filing jointly, can contribute to a traditional ira.

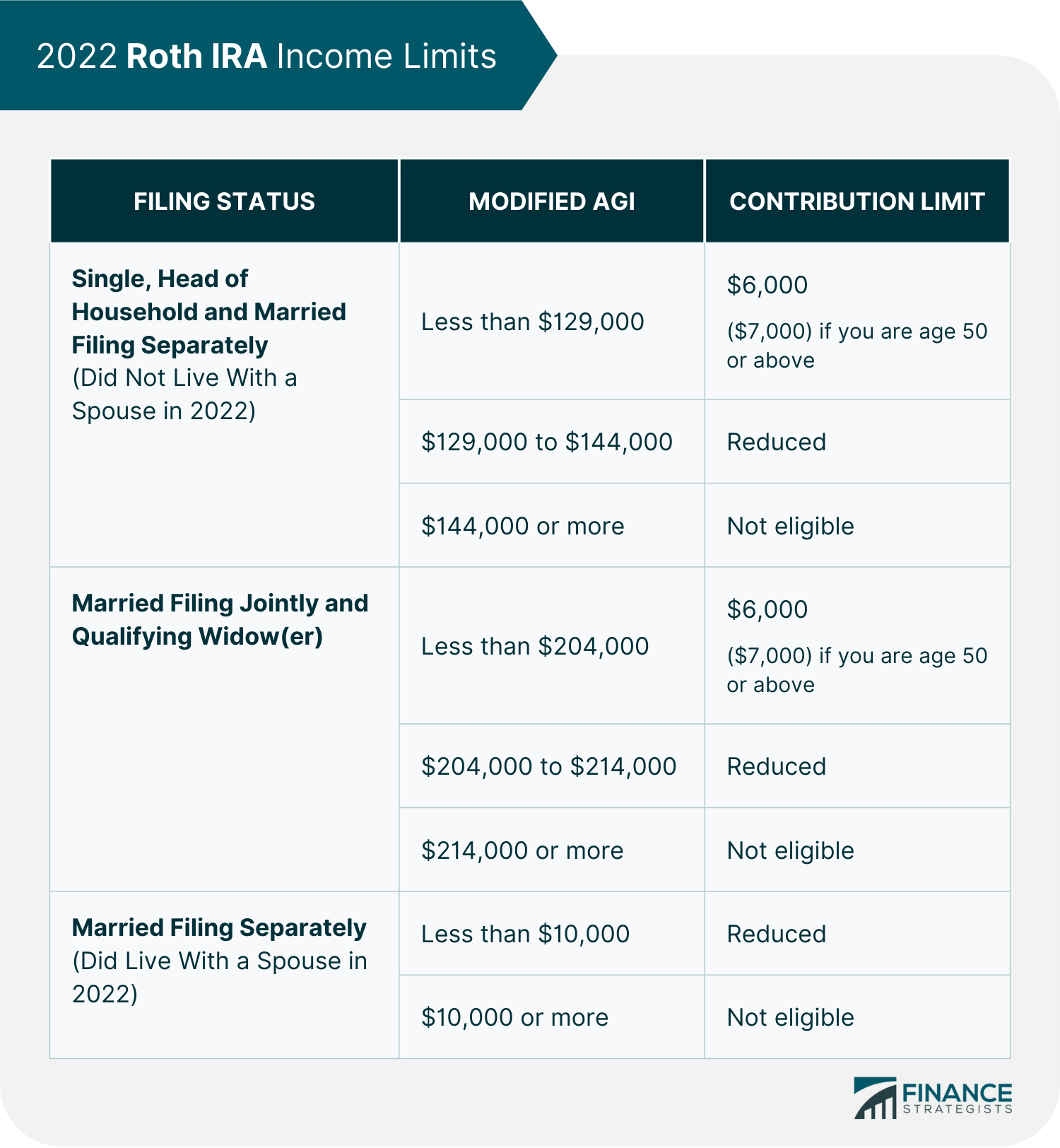

Limits For 2025 Roth Ira Image to u, — similarly, married couples filing jointly enter the partial contribution range when magi reaches $230,000 in 2025, up from $218,000 in 2025.

Married Filing Jointly Roth Ira Limits 2025 Judy Clementia, — 2025 roth ira income limits.

401k Limits 2025 Married Filing Jointly Val Aloysia, — in 2025, if your tax filing status is married filing jointly, you can still contribute the full amount ($7,000, or $8,000 if you’re age 50 or older).

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, Anyone with an earned income and their spouses, if married and filing jointly, can contribute to a traditional ira.

Roth Ira Limits 2025 Married Filing Jointly Dody Nadine, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth ira, and if you’re married and filing jointly, your magi must be under $228,000 for tax year 2025 and $240,000 for tax year 2025.

Roth Ira Contribution Limits 2025 Married Jointly Erda Odelle, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age.

Married Filing Jointly Roth Ira Limits 2025 Judy Clementia, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth ira, and if you’re married and filing jointly, your magi must be under $228,000 for tax year 2025 and $240,000 for tax year 2025.

Roth Ira Limits 2025 Married Filing Jointly Dody Nadine, — in 2025, the income limit for the credit increased to $76,500 for married couples filing jointly, up from $73,000 in 2025.

Roth Ira Limits Married Filing Jointly 2025 Kassi Matilda, $7,000 for people aged 49 and under $8,000 for people aged 50 and over (the extra $1,000 is known as a catchup.